Why “fiber optic assets are gold mines”? Huawei says so

Building infrastructure of any kind is not cheap, and building communications infrastructure is especially challenging. However, operators cannot afford the cost of not expanding capacity, and the current epidemic has further demonstrated the importance of connectivity. Operators that cannot consolidate their infrastructure as soon as possible are likely to lose their customers to competitors.

According to data from Omdia (formerly known as Ovum Research), since the beginning of 2017, with the continuous advancement of the network fixed-mobile convergence strategy, the deployment of wide-coverage optical fiber networks has become an urgent problem for operators to solve. Since FTTx construction requires a large amount of investment, the realization of optical fiber assets has become an effective means for operators to quickly obtain cash for reinvestment. The valuation multiple (EV/EBITDA) of the optical fiber wholesale business has increased rapidly from 2016 to 2018. In 2018, the valuation multiple of the optical fiber wholesale business exceeded the valuation multiple of the railway wholesale business.

“Optical fiber is a gold mine.” Carol Wang, a senior financial expert at Huawei’s Carrier BG, spoke at the company’s global analyst conference. In this difficult environment, telecommunications companies have brought a more positive business cycle by monetizing their assets, including precious optical fibers, for the expansion and construction of optical networks.

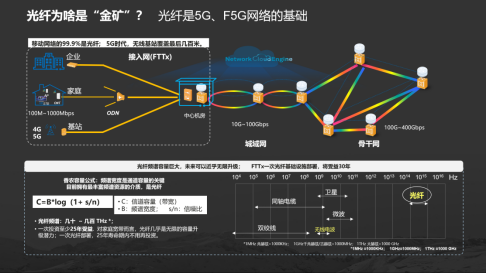

Why “fiber optic assets are gold mines”? Carol Wang said that optical fiber is a solid foundation for 5G and F5G networks. For 5G networks, wireless waves cover the last few hundred meters, and more than 99.9% of the network is connected by optical fibers. The spectrum capacity of optical fibers is huge, and it can be upgraded almost infinitely in the future. FTTx will benefit from the deployment of optical fiber infrastructure for at least 25 years.

According to our analysis, she said that in the past ten years, the average investment return rate of the ICT industry was >6%, while the investment return rate of the insurance industry was 4%-6%. More and more insurance and other infrastructure funders are paying attention. Carol Wang cites two cases to illustrate how this is done.

The first case comes from a French operator S, which faced financial difficulties in 2018, but still needs to improve network quality to enhance competitiveness. At the same time, it has obtained an exclusive license from the local government to provide FTTH services to 4 million users, and through business reorganization, it has solved the bottleneck of optical network investment.

First, it divested its fiber optic assets and established a separate subsidiary as a fiber optic wholesaler. Then, based on market fair value, its fiber optic assets were revalued from a book value of 500 million euros to 3.6 billion euros, and a 49.99% stake in the new company was sold to three insurance companies for 1.7 billion euros. At the same time, after the subsidiary introduced new investors, it reduced leverage and obtained a refinancing credit line of 1.8 billion euros. The funds were then used to expand the coverage of the fiber optic network, which greatly eased the pressure on network construction and helped it accelerate the deployment of fiber optic network wide coverage.

The second case comes from Brazilian operator T, which decided to adopt a business model strategy of block differentiation.

In first-tier cities, it owns and controls its own fiber optic assets; in second-tier cities, it saves money by cooperating with ATC to build networks. In late 2019, the company announced a third model, the franchise model, which is for cities with a population of 20,000 to 50,000. The company hopes to increase its fiber footprint by 1 million homes by 2021. Operator T will provide maintenance services, technical training, and network management through its local brand, provide access to suppliers and a central call center, and specify the network topology. Meanwhile, the franchisee will be responsible for the infrastructure and provide sales, service and installation.

The all-optical network has entered the industrialization layout. Through the introduction of capital market funds and multi-party participation, the process of deploying and covering optical fiber networks has been greatly accelerated, thereby redefining the value of optical fibers and realizing a positive business cycle, Carol Wang said.

She said that through different business models such as fiber monetization, operators have overcome the rift in fiber network construction (huge investment pressure), and transformed this “gold mine” into a strong foundation for future network business development.