The International Energy Agency released the “World Energy Outlook 2022”

On October 27, the International Energy Agency (IEA) released the “World Energy Outlook 2022” report, pointing out that the global energy crisis may become a historic turning point towards a cleaner and safer world. The current global energy crisis is bringing unprecedented and complex shocks, with natural gas, coal, oil and electricity markets most volatile. The report’s established policy scenario based on the latest global policy settings shows that by 2030, the new measures will help promote global clean energy investment of more than US$2 trillion per year, an increase of more than 50% from the current level. With support for nuclear power and renewables, coal use will fall back over the next few years, gas demand will plateau in the late 2020s, and oil demand will plateau around 2035 and decline slightly by 2050. The main points of the report are as follows:

1. The causes and effects of the global energy crisis

1. The risk of further energy disruption and geopolitical fragmentation remains high

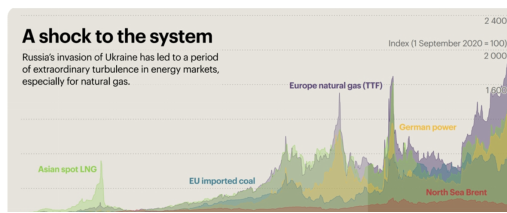

The energy crisis triggered by the conflict between Russia and Ukraine has had a profound impact on households, businesses and the entire economy around the world, prompting governments to take emergency measures to reduce the risk of future energy interruptions in their countries and enhance energy security. High energy prices cause consumers to pay more wealth to producers, and the number of people who cannot use modern energy has risen for the first time in decades. About 75 million people in the world may not be able to pay electricity bills, and 100 million people will return to traditional biomass energy. cooking. There are still huge uncertainties about how this energy crisis will evolve and how long fossil fuel prices will stay high, and the risk of further energy disruptions and geopolitical fragmentation remains high.

Figure 1 The conflict between Russia and Ukraine has led to abnormal turbulence in the energy market (especially the natural gas market)

2. The long-term strategy to solve the energy crisis is to develop low-emission energy

The crisis will boost demand for oil and coal in the short term, but in the long term the long-term solution to the crisis will still come from low-emission energy sources, primarily renewables and, in some cases, nuclear power, as well as the combination of efficiency and Faster progress on electrification. In the Stated Policies Scenario, global energy demand grows by about 1% per year to 2030, almost entirely met by renewable energy. Coal demand peaks in the next few years, gas demand plateaus towards the end of the decade, and oil demand peaks in the mid-2030s before declining slightly. The share of fossil fuels in the global energy mix will drop from 80 percent today to 75 percent in 2030, and to just over 60 percent by mid-century.

3. Developing a flexible and diverse clean energy supply chain is the future trend

Cost pressures are being felt across the energy sector due to continued strain on supply chains and rising prices for essential building materials such as key minerals, cement and steel. But the current rise in the cost of clean energy technologies is expected to be temporary and to recede until manufacturing innovations are complete. However, current trends are driving governments to pay more attention to the resilience and diversity of clean energy supply chains.

2. Updated roadmap to achieve net-zero emissions by 2050

1. Achieving net zero emissions by 2050 is still achievable

In 2021, global carbon emissions will increase by a record 1.9 billion tons to 36.6 billion tons. Despite this unsatisfactory status quo, net zero emissions by 2050 are still achievable. In the net-zero emissions scenario, low-emissions energy supply would increase by about 125 exajoules from 2021 to 2030, equivalent to the increase in world energy supply over the past 15 years. Among the low-emission energy categories, modern biomass and solar energy increase the most, by about 35 exajoules and 28 exajoules, respectively, by 2030. But by 2050, the greatest growth in low-emissions energy supply will come from solar and wind power, with fossil fuels for energy use accounting for just 5% of total energy supply.

2. In a net-zero emissions scenario, electricity will be key to transforming the global energy system

By 2050, electricity will provide more than half of the final energy consumption, and the total power generation will grow at a rate of 3.3% per year, which is higher than the growth rate of the global economy in the same period. Annual new capacity additions from all renewables will quadruple, from 290 GW in 2021 to around 1,200 GW in 2030. By 2030, the proportion of renewable energy in total power generation will exceed 60%; by 2050, the annual newly installed nuclear power capacity will be four times the current average level.

3. In a net-zero emissions scenario, energy-saving measures will help increase clean energy supply

In the net-zero emissions scenario, energy intensity improves almost three times faster by 2030 than in the past decade, and the energy savings from energy efficiency, material utilization, and behavioral change are about 110 exajoules, equivalent to the current Chinese end-use total energy consumption. By 2050, the carbon emissions of the final energy sector will be reduced by more than 90%. Among them, hydrogen and hydrogen-based fuels will be used in heavy industry and long-distance transportation, and their share in the total final energy consumption will reach about 10% by 2050. For sustainable development, the use of biomass energy will remain at about 100 exajoules, and its share in total final energy consumption will reach about 15% by 2050. The total amount of CO2 captured will reach 1.2 billion tons in 2030, and will increase to 6.2 billion tons in 2050, of which more than 60% will come from industry and other energy transition sectors.

Note: ① By 2025, there will be no new sales of fossil fuel boilers, and nearly 50% of electricity will come from low-emission energy sources; ② By 2030, sales of electric vehicles will account for 60% of global car sales, and the installed capacity of electrolyzers will reach 720 GW. 8% of cement production will be equipped with carbon capture and storage technology; ③By 2035, no new small cars with internal combustion engines will be sold, the global CO2 capture capacity will reach 3 billion tons, and the power sector in developed economies will achieve net zero emissions; ④By 2035 By 2040, 50% of existing buildings will be converted to zero-emission levels, and electricity will account for 40% of industry-related energy consumption; ⑥By 2045, new heavy-duty trucks with internal combustion engines will no longer be sold, and heat pumps will meet 50% of heating demand; ⑦By 2050, the installed capacity of electrolyzers will reach 3,670 GW, and nearly 90% of the electricity will come from renewable energy.

4. In the net-zero emissions scenario, clean energy investment will increase significantly

Between 2017 and 2021, clean energy investment accounts for about 2% of global GDP per year. In a net-zero emissions scenario, this rises to almost 4% by 2030. Investment in renewable energy generation will increase the most, from $390 billion today to $1,300 billion in 2030. In addition, clean energy technologies are rapidly being rolled out. The announced global electric vehicle battery production capacity in 2030 is only 15% lower than the battery demand in the net zero emission scenario; the announced solar photovoltaic production capacity basically reaches the deployment level set in the net zero emission scenario. If the projects deployed are completed on schedule, the cumulative installed capacity of electrolyzers will reach 380 GW by 2030, more than half of the 2030 demand in the net-zero emissions scenario. However, progress in many areas has fallen far short of what is envisioned in the net-zero emissions scenario. Policy makers should accelerate measures to take the clean energy supply chain as a whole, ensure the diversity and resilience of the supply chain, and promote the coordinated development of different links and sectors in the supply chain.

3. Energy Security in Energy Transition

The volatile rise in fossil fuel prices following the Russia-Ukraine conflict highlights the risks inherent in today’s energy system and the importance of energy security to economies and everyday life. The energy transition presents an opportunity to build a safer and more sustainable energy system, reducing energy bills while reducing the risk of fuel price volatility. In the energy transition, ten major measures need to be taken to ensure energy security in the process of “medium-term energy transition”, that is, the coexistence system of clean energy and fossil fuels, and the provision of economically viable energy services.

1. Expand the application scale of clean energy technologies and reduce the use of fossil fuels

Investing in clean energy is key to avoiding an energy crisis while reducing carbon emissions. In the 2050 net-zero emissions scenario, for every dollar spent on fossil fuels by 2030, roughly $9 goes to clean energy. Cutting investment in fossil fuels before scaling up investment in clean energy would push up energy prices and may be detrimental to a safe transition to the energy transition. High fossil fuel prices could increase the cost of meeting climate goals for fossil fuel importing countries by 10%-25%.

2. Prioritize the improvement of energy efficiency

The energy crisis has highlighted the critical role of energy efficiency and behavioral measures in alleviating supply-demand mismatches. Since 2000, energy-saving measures have significantly reduced unit energy consumption, but the progress of energy-saving improvements has slowed down in recent years. Policies to promote energy-efficiency retrofits are crucial, as more than half of the buildings in use by 2050 have already been built.

3. Prioritize the development of new energy economy in poor communities

Due to COVID-19 and the energy crisis, some 75 million people around the world have lost the ability to pay for extended electricity service, and 100 million people have lost the ability to clean cooking solutions. In emerging market and developing economies, the poorest households use nine times less energy than the richest households, but spend a much higher share of their income on energy than the richest households. Reversing these trends of worsening energy poverty is critical to a secure, people-centred energy transition.

4. Promote global cooperation and reduce investment costs in emerging markets and developing economies

In 2021, the investment cost of solar photovoltaic power plants in major emerging economies will be 2-3 times higher than that of developed economies and China. Addressing associated risks and reducing investment costs in emerging and developing economies by 200 percent would reduce the cumulative financing costs of achieving net-zero emissions by $15 trillion by 2050.

5. Promote the scrapping and reuse of infrastructure

Even in a rapid energy transition, some parts of the existing fossil fuel infrastructure will remain functional for some time. These include gas-fired power plants for electricity security (in the EU, peak demand for gas will continue to rise until 2030) or oil refineries (to fuel the remaining fleet of internal combustion engines). Unplanned or premature decommissioning of such infrastructure can negatively impact energy security.

6. The development of diversified energy sources is crucial to reducing energy risks

Several countries are investing the vast sums they receive from oil and gas in renewable energy and low-emission hydrogen. Hydrogen’s potential export revenues cannot replace oil and gas, but low-cost renewable energy and carbon capture, utilization and storage could provide durable foreign exchange advantages by attracting investment in energy-intensive industries.

7. Promoting investment flexibility is the core of ensuring power supply

Reliable electricity is at the heart of a successful energy transition as the share of electricity in final energy consumption rises from 20% today to 50% in a net-zero emissions scenario by 2050. Constant changes in electricity supply and demand mean that the requirement for electricity flexibility in a net-zero emissions scenario could quadruple by mid-century. Battery energy storage and demand-side response are becoming increasingly important, and in 2050, battery energy storage and demand-side response will each meet a quarter of the flexibility needs under the committed target scenario.

8. Ensuring the diversity and resilience of clean energy supply chains

In the Commitment Scenario and the Net Zero Emissions Scenario, the demand for mineral resources for clean energy technologies will quadruple by 2050, and trade will reach $400 billion. High and volatile prices of key minerals and highly centralized supply chains will delay or make the energy transition more expensive. Minimizing this risk will require action to scale up and diversify supply, along with other measures, such as recycling, to moderate the rapid growth in mineral demand.

9. Promoting climate resilience in energy infrastructure

The increasing frequency and intensity of extreme climate events around the world pose significant risks to securing energy supplies. The IEA analysis suggests that the potential impact of flooding on infrastructure will amount to 1.2% of total asset value by 2050. Governments need to anticipate risks in a timely manner and ensure that energy systems are capable of coping with and recovering from adverse climate hazards.

10. The government should actively specify the strategic direction of energy development

The government needs to address the imbalance in the market energy system and take the lead in ensuring energy security transition. Transformation may be less effective if managed solely on a top-down basis. The government needs to use the huge market resources to incentivize the private sector to play its role. About 70% of the investment required to achieve a successful energy transition needs to come from private capital.

4. Energy Demand Outlook

1. The current global economic crisis, high energy prices, energy security issues, etc. have caused the forecast for energy demand growth in this outlook to be lower than the forecast in last year’s report

In the Stated Policies Scenario, average annual growth in global energy demand slows to 0.4% by 2030, down from 2.3% between 2010 and 2019. Coal demand has temporarily surged in power and industrial sectors in some regions due to higher natural gas prices. Renewable energy, especially solar PV and wind, will account for 43% of global electricity generation by 2030, up from 28% today. Oil demand will continue to grow at an annual rate of 0.8% until 2030, peaking at 103 million barrels per day. But oil demand will stop growing after that, thanks to electric vehicles and improved energy efficiency.

Note: STEPS: Stated Policy Scenario; APS: Promised Target Scenario

2. Under the commitment target scenario, if countries fulfill their national net zero emission commitments, the use of fossil fuels will further decline by 2030 compared with the established policy scenario

Compared with the Stated Policies Scenario, all sectors accelerate the electrification transition and improve energy efficiency under the Committed Targets Scenario. Among them, electric vehicles in the transportation sector and heating in the building sector are the most prominent. At the same time, the share of renewable energy in the power sector is expanding, accounting for nearly 50% of total electricity generation by 2030. These changes will ultimately result in end-users spending more upfront on high-efficiency and low-emissions equipment in the Commitment Target Scenario, but the cost of these devices will decline faster in the Commitment Target Scenario than in the Stated Policies Scenario due to economies of scale. quick.

3. In the Stated Policy Scenario, energy-related carbon emissions will continue to increase over the next two years and begin to decline by the mid-2020s

Global carbon emissions will drop to 36.2 billion tons by 2030, slightly below current levels. In the Commitment Target Scenario, global carbon emissions will drop to 31.5 gigatons by 2030 as governments take aggressive action. The private sector plays an important role in the Commitment Target Scenario, with nearly 800 companies around the world committing to net zero emissions, including steel, cement, aviation, shipping and other industries. However, even aggressive action in the Pledge Target Scenario falls well short of achieving net-zero emissions by 2050.

4. In developing countries, high prices and inflation will hinder the transformation of energy modernization

For the first time in decades, the number of people unable to pay for electricity could rise in 2022. At the same time, a surge in the price of LPG could prompt as many as 100 million users of modern cooking technology to switch to traditional fuels. These headwinds mean that the number of people without electricity service by 2030 is projected to be higher in this year’s Stated Policy Scenario than in last year’s projections. Fully achieving energy modernization by 2030 will require more ambitious actions and higher levels of investment.

5. Improving energy efficiency will help ease electricity demand for building cooling

Some 5 billion people today live in regions with a high demand for cooling buildings, yet only one-third of these households have air conditioning, and most of these households are located in advanced economies. By 2050, with climate change and population growth, the number of people who need to cool buildings will increase to 7 billion. In the Stated Policy Scenario, electricity demand for cooling buildings is close to 5,200 TWh by 2050, with 90% of the increase coming from emerging market and developing economies. Electricity demand for cooling buildings would be reduced by more than 50% in the Committed Target Scenario compared to the Stated Policies Scenario due to improvements in the energy efficiency of air conditioning and the use of passive cooling measures in buildings.

6. The rapid adoption of electric vehicles will lead to an earlier peak in oil demand

Peak oil demand is brought forward from the mid-2030s in the Stated Policies Scenario to the mid-2020s in the Committed Targets Scenario due to the rapid adoption of electric vehicles. In the committed target scenario, electric vehicles will account for more than 35% of global car sales by 2030, and sales in China, the European Union and the United States will account for more than 50%. Therefore, by 2030, the global electric vehicle market will be six times larger than in 2021.

5. Electric Power Outlook

1. Electricity will account for an increasing share of final energy consumption in all scenarios

By 2030, global electricity demand will increase to 5,900 TWh in the Stated Policies Scenario and more than 7,000 TWh in the Committed Target Scenario, equivalent to the current level of overall demand in the United States and the European Union. In advanced economies, the market share of EVs rises from about 8% in 2021 to 32% in the Stated Policies Scenario and nearly 50% in the Committed Targets Scenario by 2030, with transport being the largest contributor to electricity demand growth . In emerging markets and developing economies, population growth and increased cooling needs for buildings will lead to increased electricity demand. In China, by 2030, the number of air conditioners will increase by about 40% compared with the current established policy scenario and committed target scenario. In all economies, electricity will account for an increasing share of final energy consumption. By 2050, global electricity demand will increase by more than 75% in the Stated Policies Scenario, 120% in the Committed Target Scenario, and more than 150% in the Net Zero Emissions Scenario.

Figure 4 By 2030, the proportion of low-emission electricity led by renewable energy is expected to exceed that of fossil fuel power generation in the established policy scenario and committed target scenario (unit: TWh)

2. The current rising trend of coal consumption in the energy industry in many countries is temporary

Coal use in the energy sector has risen in many countries due to strong demand, high gas prices and energy security concerns, but this is expected to be a temporary blip. Even in the Stated Policy Scenario, coal’s share of electricity generation falls from 36% in 2021 to 26% in 2030 and 12% in 2050, in contrast to renewables dominated by solar PV and wind The share will continue to grow. In the Pledge Target Scenario, the share of renewable energy in total electricity generation rises from 28% in 2021 to about 50% in 2030 and 80% in 2050. By 2050, the share of unabated coal will drop to just 3%. Solar PV installed capacity will grow from 151 GW in 2021 to 370 GW in 2030 and nearly 600 GW in 2050, while wind power capacity will double to 210 GW in 2030, to This will grow to 275 GW in 2050. Recent global events are changing the perception of natural gas, while also highlighting the potential of nuclear energy to reduce emissions and enhance electricity security.

3. The affordability and security of the global power system will encounter many challenges in 2021

Market conditions and the energy crisis are expected to increase the average global cost of electricity supply by almost 30% in 2022. In the first half of 2022, wholesale electricity prices tripled compared to the same period of the previous year, and the EU is facing huge cost pressures. This was largely driven by record high natural gas prices, which coincided with higher coal and oil prices, exacerbated by declining availability of nuclear and hydropower. Climate-related risks, including heat waves, droughts, extreme cold and extreme weather events, have strained power grids around the world and caused multiple large-scale blackouts. An ever-optimizing electricity mix will partially mitigate the impacts of climate change, but exacerbate others.

4. Carbon emissions from power generation will peak soon

In 2021, the carbon emissions of the energy industry will reach 13 billion tons, accounting for more than one-third of the total global energy-related CO2 emissions. In all scenarios, CO2 emissions from the energy sector peak in the near future. By 2050, carbon emissions from electricity production will be reduced sharply by 40% in the Stated Policies Scenario; by more than 80% in the Commitment Target Scenario; and in the Net Zero Emissions Scenario, electricity-related net emissions will reach zero by 2040. In advanced economies, energy sector emissions, which have been falling since 2007, will see a temporary rise in 2021 due to the COVID-19 pandemic. In emerging market and developing economies, electricity-related carbon emissions peak soon and fall by more than 1% per year by 2050 in the Stated Policies Scenario and 6% in the Committed Targets Scenario. The ever-increasing investment in the energy industry will accelerate the pace of electricity-related carbon emission reductions. In the established policy scenario, the investment in the energy industry will increase from an average annual US$860 billion in 2017-2021 to about US$1.2 trillion in 2022-2050. This would increase to $1.6 trillion in the committed target scenario and $2.1 trillion in the net-zero emissions scenario.

5. Power system flexibility is the cornerstone of power guarantee

Demand for power system flexibility will double in the Commitment Target Scenario by 2030 and nearly quadruple by 2050, with changing power system demand patterns and growing adoption of solar PV and wind power. Demand for power system flexibility also increases rapidly in the Stated Policy Scenario, more than tripling by 2050. Today, power system flexibility is largely provided by unabated coal, natural gas and hydropower, but in the future, power systems will increasingly rely on energy storage batteries, demand response, bioenergy and other variable renewable energy sources, Fossil fuels, hydrogen and ammonia with integrated carbon capture.

6. Power grid modernization will effectively support the successful transformation of energy

Average annual investment in grid modernization in the Stated Policy Scenario increases from about US$300 billion in recent years to US$550 billion by 2030, reaching an average of US$580 billion per year by 2050. In the committed target scenario, grid modernization investment will rise further to US$630 billion by 2030 and US$830 billion by 2050. However, complex projects can take a decade or more to deliver, in most cases twice as long as it takes to develop solar PV, wind or electric vehicle charging infrastructure. Therefore, long-term government planning is crucial and must take into account factors such as demand growth, the increasing share of variable renewable energy, and digital technologies.

7. Critical mineral resources are a key component of the energy and power security sector

In the Stated Policy Scenario, demand for critical mineral resources related to the energy sector rises from 7 Mtpa in 2021 to 11 Mtpa in 2030 and 2050 due to increased renewable energy, battery storage and grid deployment. 13 million tons. Demand for critical mineral resources grows faster in both the Commitment Target Scenario and the Net Zero Emissions Scenario, reaching 20 Mtpa by 2050. Copper metal for power grids, silicon for solar photovoltaics, rare earth elements for wind turbines and lithium for batteries will all be key mineral resources. More research and development is needed in the future to reduce mineral resource intensity and enable resource substitution in critical applications, along with measures such as recycling electric vehicle batteries and improving energy efficiency in end-use applications.

6. Outlook for liquid fuels

1. The current global oil market is facing huge uncertainties

The economic recession has seriously affected the demand in the oil market in the near future, and the sanctions against Russia and the continuous reduction of spare capacity have brought great uncertainty to the global market. Despite the current sharp increase in oil and gas prices, investors remain hesitant about how best to invest given the possibility of a structural shift in oil consumption in the coming decades. In the Stated Policy Scenario, global oil demand rebounds by 2023 and surpasses 2019 levels despite high oil prices; demand peaks at 103 million barrels per day in the mid-2030s. In the Committed Targets scenario, stronger policy action would bring forward peak oil demand to the mid-2020s. In the 2050 net-zero emissions scenario, faster global action to reduce emissions means oil demand never returns to 2019 levels, falling to 75 mb/d by 2030.

Note: STEPS: Stated Policy Scenario; APS: Committed Target Scenario; NZE: Net Zero Emissions Scenario

2. In the long run, the demand for oil in the transportation sector will decrease

Electric vehicles will account for about 10% of global car sales in 2021. This rises to 25% in the Stated Policies Scenario and 60% in the Net Zero Emissions Scenario by 2030. Electric trucks and fuel cell heavy-duty trucks struggle to gain market share in the Stated Policies Scenario, but in the Net Zero Emissions Scenario, they account for 35% of total truck sales in 2030. Aviation and shipping will consume 10 million barrels per day of oil in 2021, a 20% reduction from pre-COVID-19 levels. In the Stated Policy Scenario, where economic growth boosts global trade and international travel, oil demand grows by 4 million barrels per day between 2021 and 2030. In the Pledge Target Scenario, increasing the use of alternative fuels to meet government and industry climate targets increases oil demand by 3 million barrels per day by 2030. In the net-zero emissions scenario, the choice of low-emission liquid fuels would result in little increase in oil demand by 2030.

3. Petroleum demand in the chemical industry will continue to increase under all scenarios

The chemical industry is the only sector to increase oil consumption in 2020, and its share of oil consumption rises in each scenario. Currently, approximately 70% of petroleum used as a petrochemical raw material is used to produce plastics. Several countries have currently announced policies to ban or reduce the production of single-use plastics, increase recycling rates and promote alternative raw materials. By 2050, the global average plastic recycling rate will increase from the current 17% to 27% in the Stated Policies Scenario, to 50% in the Pledge Target Scenario, and to 54% in the Net Zero Emissions Scenario.

4. Increase upstream investment in oil production to ensure a balance between oil supply and demand

In the Stated Policy Scenario, rising demand and falling production from existing sources of oil production implies the need for new conventional upstream projects to ensure that supply and demand remain in balance. By 2030, annual spending on oil production upstream investment averages around $470 billion, 50% higher than current spending. In the Commitment Target Scenario, despite lower oil demand, new conventional projects are still needed, with an average annual investment of $380 billion to 2030. In a net-zero emissions scenario, the decline in fossil fuel demand can be met without the development of new oil projects, but with continued investment in existing assets, which would require an average annual upstream investment of $300 billion by 2030 .

5. In 2021, global refining capacity will decline for the first time in more than 30 years

Refining margins have soared to record highs as demand rebounds in 2022 and exports of petroleum products from Russia and China fall. In the Stated Policy Scenario, rising demand for diesel and kerosene means that the market is likely to remain very tight for several years. Strong policy measures to curb demand for liquid fuels would significantly ease this energy crunch in the Commitment Target Scenario. The Commitment Target Scenario and the Net Zero Emissions Scenario require refiners to adjust their current structural configurations and business models and invest more in emissions reductions, hydrogen and biofuels.

6. Demand for liquid biofuels will continue to increase in the future

Disruptions to food supply chains and high fertilizer prices mean the cost of liquid biofuels has skyrocketed. At the same time, growing concerns about sustainability have prompted increased attention to advanced liquid biofuels that do not directly compete with food and feed crops and avoid adverse impacts on sustainability. Liquid biofuels grow from 2.2 million barrels of oil equivalent per day in 2021 to 3.4 million barrels of oil equivalent per day in 2030 in the Stated Policies Scenario and to 5.5 million barrels of oil equivalent per day in the Committed Targets Scenario, This would increase to 5.7 million barrels of oil equivalent per day in a net-zero emissions scenario.

7. Gas fuel outlook

1. The era of rapid growth in global natural gas demand is coming to an end

The depth and breadth of the current global energy crisis has raised concerns about the future cost and availability of natural gas, severely undermining firm ideas about its use as a transition fuel. In the Stated Policy Scenario, gas demand grows by less than 5% between 2021 and 2030, compared with 20% growth over the past decade. From 2030 to 2050, global natural gas demand will remain at about 4.4 trillion cubic meters, with increasing demand in emerging market and developing economies offset by weaker demand in advanced economies. In the Committed Target Scenario, global gas demand peaks soon, with demand in 2030 10% below 2021 levels. In the net-zero emissions scenario, demand falls by 20% by 2030 relative to 2021 levels and by 75% by 2050.

2. The energy crisis will lead to a continuous reduction in the demand for natural gas in the EU

At present, Russia’s pipeline gas exports to the EU have more than halved compared with last year, and the total export volume is expected to be 60 billion cubic meters in 2022. A further 45 bcm would be reduced by 2030 in the Committed Targets Scenario and to zero in the Stated Policies Scenario. Two options, additional LNG imports and non-Russian pipeline gas, will play an important role. In the Commitment Target Scenario, the increases in wind and solar capacity are more pronounced and lead to more building retrofits and heat pump installations, measures that would help EU gas demand fall by 40% between 2021 and 2030 %, that is, 180 billion cubic meters.

3. Global natural gas prices will begin to gradually decline in the mid-2020s

Due to the reduction of natural gas imports from Russia and the lack of new natural gas import projects in Europe, it means that in the next few years, in the established policy scenario and the committed target scenario, the price of European natural gas imports will still be high. In a net-zero emissions scenario, natural gas demand would decrease rapidly in all regions of the world, global natural gas supply pressure would ease, and natural gas import prices would fall rapidly. Gas prices begin to decline gradually in the mid-2020s in both the Stated Policies Scenario and the Committed Targets Scenario, as gas demand flattens and new supply projects currently under construction come on stream. The decline in domestic natural gas demand in the United States creates an opportunity to increase LNG exports. In the Stated Policy Scenario and Committed Target Scenario, the United States will soon surpass Russia to become the world’s largest natural gas exporter. In the Stated Policy Scenario, China’s natural gas demand growth will slow down significantly, with a demand reduction rate of 2% per year between 2021 and 2030, compared with an average annual growth rate of 12% over the past decade. China has already signed a large number of LNG contracts over the next 15 years, and together with the expected supply from existing pipelines and new domestic projects, this capacity exceeds China’s demand for natural gas by 2035 in the Stated Policy Scenario.

4. The high price of natural gas has weakened the prospect of large-scale application of coal-to-gas conversion

In emerging markets and developing Asia in Asia, long-term gas import contracts with prices tied to oil provide consumers with partial protection from high and volatile gas prices, in some cases backed by domestic subsidized support. Growing populations and strong economies provide a solid basis for growth in gas demand in these regions: by 2030, gas demand in these emerging markets in Asia will increase by 20% to 12 billion cubic meters in the Committed Target Scenario, of which about 70 billion cubic meters % growth was due to imports of liquefied natural gas. Growing gas demand in parts of Asia and EU measures to import non-Russian gas underpin LNG demand growth in all scenarios until the mid-2020s, but there will be a dramatic change thereafter. In the Stated Policy Scenario, an additional 240 billion cubic meters of export capacity per year would be required by 2050, in addition to projects already under construction. In the committed target scenario, only projects currently under construction are required. In a net-zero emissions scenario, the sharp decline in global gas demand means that projects currently under construction will in many cases no longer be needed. This has prompted investors in large capital-intensive LNG projects to face a key dilemma: the imbalance between strong demand growth for gas in the short term and the uncertainty that gas demand may decrease in the longer term.

5. Russia will face a difficult choice in finding new natural gas export markets

Sanctions have dampened prospects for new major LNG projects in Russia, while the distance to alternative markets for gas exports has made new pipeline connections difficult. In the committed target scenario, Russia’s share of international gas transactions would fall from 30% in 2021 to less than 15% in 2030, and its net gas export revenue would fall from $75 billion in 2021 to $25 billion in 2030. Dollar.

6. The application prospect of low emission gas is bright

In the Committed Target Scenario, low-emissions hydrogen production would rise from current low levels to over 30 million tonnes per year by 2030, equivalent to more than 100 billion cubic meters of natural gas. Biomethane production would also increase in the committed target scenario. Governments should play a key coordinating role in the growth of low-emitting gases, especially in setting standards and ensuring reliable long-term demand.

8. Outlook for solid fuels

1. The current coal demand growth is strong, but the long-term trend still depends on the world’s determination to deal with climate change

As the world recovers from the epidemic, global coal demand will rebound strongly to 5.64 billion tons in 2021, and coal-fired power generation will reach an all-time high in 2021. Both China and India have stepped up investment in domestic coal production, but global output has struggled to keep pace with demand growth, sending coal prices soaring. The conflict in Russia, the world’s third-largest coal exporter, has complicated the coal market and put additional pressure on coal prices. The future of coal depends largely on the world’s determination to tackle climate change. In the Stated Policy Scenario, coal demand will gradually decline. In the committed target scenario, coal demand falls by around 20% from current levels by 2030 and by 70% by 2050; coal demand in China and India peaks in the early 2020s and late 2020s, respectively. In the 2050 net-zero emissions scenario, demand would fall by 45% by 2030 compared to today, and by 90% by 2050.

2. Future carbon capture, utilization and storage technologies will be widely used

In the Stated Policy Scenario, there is very limited application of carbon capture, utilization and storage from coal. In the Commitment Target Scenario and the Net Zero Scenario, about 500 million tons of standard coal consumed by 2050 will be equipped with carbon capture, utilization and storage facilities, which is equivalent to about 30% of the coal demand and net zero in the 2050 Commitment Target Scenario. More than 80% of coal demand in emissions scenarios. In the net-zero emissions scenario, coal use without mitigation measures would be reduced by 99% between 2021 and 2050.

3. In the committed target scenario, coal consumption will be significantly reduced by 2050

After the European Union banned coal imports from Russia, the short-lived increase in coal consumption in Europe came from several regions including Africa and Colombia. Asia accounts for more than three-quarters of global coal imports in 2021, and that share is set to rise. Despite India’s efforts to increase domestic production, in the Stated Policy Scenario, India becomes the world’s largest coal importer by the mid-2020s, while China remains by far the world’s largest producer and consumer. China’s coal consumption would drop by 60% by 2050 in the Commitment Target Scenario and 90% in the Net Zero Emissions Scenario.

4. In the net zero emission scenario, traditional biomass use will be completely phased out by 2030

In 2021, traditional cooking and heating consumed nearly 25 exajoules of biomass (equivalent to 830 million tons of coal equivalent), mainly in developing economies in Africa and Asia. In the Stated Policies Scenario, this consumption would fall by 20% by 2030, but around 2 billion people would still lack access to clean cooking fuels. In the Commitment Target Scenario, traditional biomass utilization will drop by more than 60% by 2030. In the Net Zero Emissions Scenario, clean cooking becomes widespread by 2030 and traditional biomass use is phased out entirely. About 35 exajoules of modern solid biomass were consumed in 2021, mainly for heating, electricity generation and conversion to liquid and gaseous biofuels. By 2030, the use of modern solid biomass will increase under three scenarios: by 30% in the Stated Policy Scenario, by 50% in the Committed Target Scenario, and by more than 60% in the Net Zero Emissions Scenario.

The International Energy Agency released the “World Energy Outlook 2022”

On October 27, the International Energy Agency (IEA) released the “World Energy Outlook 2022” report, pointing out that the global energy crisis may become a historic turning point towards a cleaner and safer world. The current global energy crisis is bringing unprecedented and complex shocks, with natural gas, coal, oil and electricity markets most volatile. The report’s established policy scenario based on the latest global policy settings shows that by 2030, the new measures will help promote global clean energy investment of more than US$2 trillion per year, an increase of more than 50% from the current level. With support for nuclear power and renewables, coal use will fall back over the next few years, gas demand will plateau in the late 2020s, and oil demand will plateau around 2035 and decline slightly by 2050. The main points of the report are as follows:

1. The causes and effects of the global energy crisis

1. The risk of further energy disruption and geopolitical fragmentation remains high

The energy crisis triggered by the conflict between Russia and Ukraine has had a profound impact on households, businesses and the entire economy around the world, prompting governments to take emergency measures to reduce the risk of future energy interruptions in their countries and enhance energy security. High energy prices cause consumers to pay more wealth to producers, and the number of people who cannot use modern energy has risen for the first time in decades. About 75 million people in the world may not be able to pay electricity bills, and 100 million people will return to traditional biomass energy. cooking. There are still huge uncertainties about how this energy crisis will evolve and how long fossil fuel prices will stay high, and the risk of further energy disruptions and geopolitical fragmentation remains high.

2. The long-term strategy to solve the energy crisis is to develop low-emission energy

The crisis will boost demand for oil and coal in the short term, but in the long term the long-term solution to the crisis will still come from low-emission energy sources, primarily renewables and, in some cases, nuclear power, as well as the combination of efficiency and Faster progress on electrification. In the Stated Policies Scenario, global energy demand grows by about 1% per year to 2030, almost entirely met by renewable energy. Coal demand peaks in the next few years, gas demand plateaus towards the end of the decade, and oil demand peaks in the mid-2030s before declining slightly. The share of fossil fuels in the global energy mix will drop from 80 percent today to 75 percent in 2030, and to just over 60 percent by mid-century.

3. Developing a flexible and diverse clean energy supply chain is the future trend

Cost pressures are being felt across the energy sector due to continued strain on supply chains and rising prices for essential building materials such as key minerals, cement and steel. But the current rise in the cost of clean energy technologies is expected to be temporary and to recede until manufacturing innovations are complete. However, current trends are driving governments to pay more attention to the resilience and diversity of clean energy supply chains.

2. Updated roadmap to achieve net-zero emissions by 2050

1. Achieving net zero emissions by 2050 is still achievable

In 2021, global carbon emissions will increase by a record 1.9 billion tons to 36.6 billion tons. Despite this unsatisfactory status quo, net zero emissions by 2050 are still achievable. In the net-zero emissions scenario, low-emissions energy supply would increase by about 125 exajoules from 2021 to 2030, equivalent to the increase in world energy supply over the past 15 years. Among the low-emission energy categories, modern biomass and solar energy increase the most, by about 35 exajoules and 28 exajoules, respectively, by 2030. But by 2050, the greatest growth in low-emissions energy supply will come from solar and wind power, with fossil fuels for energy use accounting for just 5% of total energy supply.

2. In a net-zero emissions scenario, electricity will be key to transforming the global energy system

By 2050, electricity will provide more than half of the final energy consumption, and the total power generation will grow at a rate of 3.3% per year, which is higher than the growth rate of the global economy in the same period. Annual new capacity additions from all renewables will quadruple, from 290 GW in 2021 to around 1,200 GW in 2030. By 2030, the proportion of renewable energy in total power generation will exceed 60%; by 2050, the annual newly installed nuclear power capacity will be four times the current average level.

3. In a net-zero emissions scenario, energy-saving measures will help increase clean energy supply

In the net-zero emissions scenario, energy intensity improves almost three times faster by 2030 than in the past decade, and the energy savings from energy efficiency, material utilization, and behavioral change are about 110 exajoules, equivalent to the current Chinese end-use total energy consumption. By 2050, the carbon emissions of the final energy sector will be reduced by more than 90%. Among them, hydrogen and hydrogen-based fuels will be used in heavy industry and long-distance transportation, and their share in the total final energy consumption will reach about 10% by 2050. For sustainable development, the use of biomass energy will remain at about 100 exajoules, and its share in total final energy consumption will reach about 15% by 2050. The total amount of CO2 captured will reach 1.2 billion tons in 2030, and will increase to 6.2 billion tons in 2050, of which more than 60% will come from industry and other energy transition sectors.

Note: ① By 2025, there will be no new sales of fossil fuel boilers, and nearly 50% of electricity will come from low-emission energy sources; ② By 2030, sales of electric vehicles will account for 60% of global car sales, and the installed capacity of electrolyzers will reach 720 GW. 8% of cement production will be equipped with carbon capture and storage technology; ③By 2035, no new small cars with internal combustion engines will be sold, the global CO2 capture capacity will reach 3 billion tons, and the power sector in developed economies will achieve net zero emissions; ④By 2035 By 2040, 50% of existing buildings will be converted to zero-emission levels, and electricity will account for 40% of industry-related energy consumption; ⑥By 2045, new heavy-duty trucks with internal combustion engines will no longer be sold, and heat pumps will meet 50% of heating demand; ⑦By 2050, the installed capacity of electrolyzers will reach 3,670 GW, and nearly 90% of the electricity will come from renewable energy.

4. In the net-zero emissions scenario, clean energy investment will increase significantly

Between 2017 and 2021, clean energy investment accounts for about 2% of global GDP per year. In a net-zero emissions scenario, this rises to almost 4% by 2030. Investment in renewable energy generation will increase the most, from $390 billion today to $1,300 billion in 2030. In addition, clean energy technologies are rapidly being rolled out. The announced global electric vehicle battery production capacity in 2030 is only 15% lower than the battery demand in the net zero emission scenario; the announced solar photovoltaic production capacity basically reaches the deployment level set in the net zero emission scenario. If the projects deployed are completed on schedule, the cumulative installed capacity of electrolyzers will reach 380 GW by 2030, more than half of the 2030 demand in the net-zero emissions scenario. However, progress in many areas has fallen far short of what is envisioned in the net-zero emissions scenario. Policy makers should accelerate measures to take the clean energy supply chain as a whole, ensure the diversity and resilience of the supply chain, and promote the coordinated development of different links and sectors in the supply chain.

3. Energy Security in Energy Transition

The volatile rise in fossil fuel prices following the Russia-Ukraine conflict highlights the risks inherent in today’s energy system and the importance of energy security to economies and everyday life. The energy transition presents an opportunity to build a safer and more sustainable energy system, reducing energy bills while reducing the risk of fuel price volatility. In the energy transition, ten major measures need to be taken to ensure energy security in the process of “medium-term energy transition”, that is, the coexistence system of clean energy and fossil fuels, and the provision of economically viable energy services.

1. Expand the application scale of clean energy technologies and reduce the use of fossil fuels

Investing in clean energy is key to avoiding an energy crisis while reducing carbon emissions. In the 2050 net-zero emissions scenario, for every dollar spent on fossil fuels by 2030, roughly $9 goes to clean energy. Cutting investment in fossil fuels before scaling up investment in clean energy would push up energy prices and may be detrimental to a safe transition to the energy transition. High fossil fuel prices could increase the cost of meeting climate goals for fossil fuel importing countries by 10%-25%.

2. Prioritize the improvement of energy efficiency

The energy crisis has highlighted the critical role of energy efficiency and behavioral measures in alleviating supply-demand mismatches. Since 2000, energy-saving measures have significantly reduced unit energy consumption, but the progress of energy-saving improvements has slowed down in recent years. Policies to promote energy-efficiency retrofits are crucial, as more than half of the buildings in use by 2050 have already been built.

3. Prioritize the development of new energy economy in poor communities

Due to COVID-19 and the energy crisis, some 75 million people around the world have lost the ability to pay for extended electricity service, and 100 million people have lost the ability to clean cooking solutions. In emerging market and developing economies, the poorest households use nine times less energy than the richest households, but spend a much higher share of their income on energy than the richest households. Reversing these trends of worsening energy poverty is critical to a secure, people-centred energy transition.

4. Promote global cooperation and reduce investment costs in emerging markets and developing economies

In 2021, the investment cost of solar photovoltaic power plants in major emerging economies will be 2-3 times higher than that of developed economies and China. Addressing associated risks and reducing investment costs in emerging and developing economies by 200 percent would reduce the cumulative financing costs of achieving net-zero emissions by $15 trillion by 2050.

5. Promote the scrapping and reuse of infrastructure

Even in a rapid energy transition, some parts of the existing fossil fuel infrastructure will remain functional for some time. These include gas-fired power plants for electricity security (in the EU, peak demand for gas will continue to rise until 2030) or oil refineries (to fuel the remaining fleet of internal combustion engines). Unplanned or premature decommissioning of such infrastructure can negatively impact energy security.

6. The development of diversified energy sources is crucial to reducing energy risks

Several countries are investing the vast sums they receive from oil and gas in renewable energy and low-emission hydrogen. Hydrogen’s potential export revenues cannot replace oil and gas, but low-cost renewable energy and carbon capture, utilization and storage could provide durable foreign exchange advantages by attracting investment in energy-intensive industries.

7. Promoting investment flexibility is the core of ensuring power supply

Reliable electricity is at the heart of a successful energy transition as the share of electricity in final energy consumption rises from 20% today to 50% in a net-zero emissions scenario by 2050. Constant changes in electricity supply and demand mean that the requirement for electricity flexibility in a net-zero emissions scenario could quadruple by mid-century. Battery energy storage and demand-side response are becoming increasingly important, and in 2050, battery energy storage and demand-side response will each meet a quarter of the flexibility needs under the committed target scenario.

8. Ensuring the diversity and resilience of clean energy supply chains

In the Commitment Scenario and the Net Zero Emissions Scenario, the demand for mineral resources for clean energy technologies will quadruple by 2050, and trade will reach $400 billion. High and volatile prices of key minerals and highly centralized supply chains will delay or make the energy transition more expensive. Minimizing this risk will require action to scale up and diversify supply, along with other measures, such as recycling, to moderate the rapid growth in mineral demand.

9. Promoting climate resilience in energy infrastructure

The increasing frequency and intensity of extreme climate events around the world pose significant risks to securing energy supplies. The IEA analysis suggests that the potential impact of flooding on infrastructure will amount to 1.2% of total asset value by 2050. Governments need to anticipate risks in a timely manner and ensure that energy systems are capable of coping with and recovering from adverse climate hazards.

10. The government should actively specify the strategic direction of energy development

The government needs to address the imbalance in the market energy system and take the lead in ensuring energy security transition. Transformation may be less effective if managed solely on a top-down basis. The government needs to use the huge market resources to incentivize the private sector to play its role. About 70% of the investment required to achieve a successful energy transition needs to come from private capital.

4. Energy Demand Outlook

1. The current global economic crisis, high energy prices, energy security issues, etc. have caused the forecast for energy demand growth in this outlook to be lower than the forecast in last year’s report

In the Stated Policies Scenario, average annual growth in global energy demand slows to 0.4% by 2030, down from 2.3% between 2010 and 2019. Coal demand has temporarily surged in power and industrial sectors in some regions due to higher natural gas prices. Renewable energy, especially solar PV and wind, will account for 43% of global electricity generation by 2030, up from 28% today. Oil demand will continue to grow at an annual rate of 0.8% until 2030, peaking at 103 million barrels per day. But oil demand will stop growing after that, thanks to electric vehicles and improved energy efficiency.

Note: STEPS: Stated Policy Scenario; APS: Promised Target Scenario

2. Under the commitment target scenario, if countries fulfill their national net zero emission commitments, the use of fossil fuels will further decline by 2030 compared with the established policy scenario

Compared with the Stated Policies Scenario, all sectors accelerate the electrification transition and improve energy efficiency under the Committed Targets Scenario. Among them, electric vehicles in the transportation sector and heating in the building sector are the most prominent. At the same time, the share of renewable energy in the power sector is expanding, accounting for nearly 50% of total electricity generation by 2030. These changes will ultimately result in end-users spending more upfront on high-efficiency and low-emissions equipment in the Commitment Target Scenario, but the cost of these devices will decline faster in the Commitment Target Scenario than in the Stated Policies Scenario due to economies of scale. quick.

3. In the Stated Policy Scenario, energy-related carbon emissions will continue to increase over the next two years and begin to decline by the mid-2020s

Global carbon emissions will drop to 36.2 billion tons by 2030, slightly below current levels. In the Commitment Target Scenario, global carbon emissions will drop to 31.5 gigatons by 2030 as governments take aggressive action. The private sector plays an important role in the Commitment Target Scenario, with nearly 800 companies around the world committing to net zero emissions, including steel, cement, aviation, shipping and other industries. However, even aggressive action in the Pledge Target Scenario falls well short of achieving net-zero emissions by 2050.

4. In developing countries, high prices and inflation will hinder the transformation of energy modernization

For the first time in decades, the number of people unable to pay for electricity could rise in 2022. At the same time, a surge in the price of LPG could prompt as many as 100 million users of modern cooking technology to switch to traditional fuels. These headwinds mean that the number of people without electricity service by 2030 is projected to be higher in this year’s Stated Policy Scenario than in last year’s projections. Fully achieving energy modernization by 2030 will require more ambitious actions and higher levels of investment.

5. Improving energy efficiency will help ease electricity demand for building cooling

Some 5 billion people today live in regions with a high demand for cooling buildings, yet only one-third of these households have air conditioning, and most of these households are located in advanced economies. By 2050, with climate change and population growth, the number of people who need to cool buildings will increase to 7 billion. In the Stated Policy Scenario, electricity demand for cooling buildings is close to 5,200 TWh by 2050, with 90% of the increase coming from emerging market and developing economies. Electricity demand for cooling buildings would be reduced by more than 50% in the Committed Target Scenario compared to the Stated Policies Scenario due to improvements in the energy efficiency of air conditioning and the use of passive cooling measures in buildings.

6. The rapid adoption of electric vehicles will lead to an earlier peak in oil demand

Peak oil demand is brought forward from the mid-2030s in the Stated Policies Scenario to the mid-2020s in the Committed Targets Scenario due to the rapid adoption of electric vehicles. In the committed target scenario, electric vehicles will account for more than 35% of global car sales by 2030, and sales in China, the European Union and the United States will account for more than 50%. Therefore, by 2030, the global electric vehicle market will be six times larger than in 2021.

5. Electric Power Outlook

1. Electricity will account for an increasing share of final energy consumption in all scenarios

By 2030, global electricity demand will increase to 5,900 TWh in the Stated Policies Scenario and more than 7,000 TWh in the Committed Target Scenario, equivalent to the current level of overall demand in the United States and the European Union. In advanced economies, the market share of EVs rises from about 8% in 2021 to 32% in the Stated Policies Scenario and nearly 50% in the Committed Targets Scenario by 2030, with transport being the largest contributor to electricity demand growth . In emerging markets and developing economies, population growth and increased cooling needs for buildings will lead to increased electricity demand. In China, by 2030, the number of air conditioners will increase by about 40% compared with the current established policy scenario and committed target scenario. In all economies, electricity will account for an increasing share of final energy consumption. By 2050, global electricity demand will increase by more than 75% in the Stated Policies Scenario, 120% in the Committed Target Scenario, and more than 150% in the Net Zero Emissions Scenario.

2. The current rising trend of coal consumption in the energy industry in many countries is temporary

Coal use in the energy sector has risen in many countries due to strong demand, high gas prices and energy security concerns, but this is expected to be a temporary blip. Even in the Stated Policy Scenario, coal’s share of electricity generation falls from 36% in 2021 to 26% in 2030 and 12% in 2050, in contrast to renewables dominated by solar PV and wind The share will continue to grow. In the Pledge Target Scenario, the share of renewable energy in total electricity generation rises from 28% in 2021 to about 50% in 2030 and 80% in 2050. By 2050, the share of unabated coal will drop to just 3%. Solar PV installed capacity will grow from 151 GW in 2021 to 370 GW in 2030 and nearly 600 GW in 2050, while wind power capacity will double to 210 GW in 2030, to This will grow to 275 GW in 2050. Recent global events are changing the perception of natural gas, while also highlighting the potential of nuclear energy to reduce emissions and enhance electricity security.

3. The affordability and security of the global power system will encounter many challenges in 2021

Market conditions and the energy crisis are expected to increase the average global cost of electricity supply by almost 30% in 2022. In the first half of 2022, wholesale electricity prices tripled compared to the same period of the previous year, and the EU is facing huge cost pressures. This was largely driven by record high natural gas prices, which coincided with higher coal and oil prices, exacerbated by declining availability of nuclear and hydropower. Climate-related risks, including heat waves, droughts, extreme cold and extreme weather events, have strained power grids around the world and caused multiple large-scale blackouts. An ever-optimizing electricity mix will partially mitigate the impacts of climate change, but exacerbate others.

4. Carbon emissions from power generation will peak soon

In 2021, the carbon emissions of the energy industry will reach 13 billion tons, accounting for more than one-third of the total global energy-related CO2 emissions. In all scenarios, CO2 emissions from the energy sector peak in the near future. By 2050, carbon emissions from electricity production will be reduced sharply by 40% in the Stated Policies Scenario; by more than 80% in the Commitment Target Scenario; and in the Net Zero Emissions Scenario, electricity-related net emissions will reach zero by 2040. In advanced economies, energy sector emissions, which have been falling since 2007, will see a temporary rise in 2021 due to the COVID-19 pandemic. In emerging market and developing economies, electricity-related carbon emissions peak soon and fall by more than 1% per year by 2050 in the Stated Policies Scenario and 6% in the Committed Targets Scenario. The ever-increasing investment in the energy industry will accelerate the pace of electricity-related carbon emission reductions. In the established policy scenario, the investment in the energy industry will increase from an average annual US$860 billion in 2017-2021 to about US$1.2 trillion in 2022-2050. This would increase to $1.6 trillion in the committed target scenario and $2.1 trillion in the net-zero emissions scenario.

5. Power system flexibility is the cornerstone of power guarantee

Demand for power system flexibility will double in the Commitment Target Scenario by 2030 and nearly quadruple by 2050, with changing power system demand patterns and growing adoption of solar PV and wind power. Demand for power system flexibility also increases rapidly in the Stated Policy Scenario, more than tripling by 2050. Today, power system flexibility is largely provided by unabated coal, natural gas and hydropower, but in the future, power systems will increasingly rely on energy storage batteries, demand response, bioenergy and other variable renewable energy sources, Fossil fuels, hydrogen and ammonia with integrated carbon capture.

6. Power grid modernization will effectively support the successful transformation of energy

Average annual investment in grid modernization in the Stated Policy Scenario increases from about US$300 billion in recent years to US$550 billion by 2030, reaching an average of US$580 billion per year by 2050. In the committed target scenario, grid modernization investment will rise further to US$630 billion by 2030 and US$830 billion by 2050. However, complex projects can take a decade or more to deliver, in most cases twice as long as it takes to develop solar PV, wind or electric vehicle charging infrastructure. Therefore, long-term government planning is crucial and must take into account factors such as demand growth, the increasing share of variable renewable energy, and digital technologies.

7. Critical mineral resources are a key component of the energy and power security sector

In the Stated Policy Scenario, demand for critical mineral resources related to the energy sector rises from 7 Mtpa in 2021 to 11 Mtpa in 2030 and 2050 due to increased renewable energy, battery storage and grid deployment. 13 million tons. Demand for critical mineral resources grows faster in both the Commitment Target Scenario and the Net Zero Emissions Scenario, reaching 20 Mtpa by 2050. Copper metal for power grids, silicon for solar photovoltaics, rare earth elements for wind turbines and lithium for batteries will all be key mineral resources. More research and development is needed in the future to reduce mineral resource intensity and enable resource substitution in critical applications, along with measures such as recycling electric vehicle batteries and improving energy efficiency in end-use applications.

6. Outlook for liquid fuels

1. The current global oil market is facing huge uncertainties

The economic recession has seriously affected the demand in the oil market in the near future, and the sanctions against Russia and the continuous reduction of spare capacity have brought great uncertainty to the global market. Despite the current sharp increase in oil and gas prices, investors remain hesitant about how best to invest given the possibility of a structural shift in oil consumption in the coming decades. In the Stated Policy Scenario, global oil demand rebounds by 2023 and surpasses 2019 levels despite high oil prices; demand peaks at 103 million barrels per day in the mid-2030s. In the Committed Targets scenario, stronger policy action would bring forward peak oil demand to the mid-2020s. In the 2050 net-zero emissions scenario, faster global action to reduce emissions means oil demand never returns to 2019 levels, falling to 75 mb/d by 2030.

2. In the long run, the demand for oil in the transportation sector will decrease

Electric vehicles will account for about 10% of global car sales in 2021. This rises to 25% in the Stated Policies Scenario and 60% in the Net Zero Emissions Scenario by 2030. Electric trucks and fuel cell heavy-duty trucks struggle to gain market share in the Stated Policies Scenario, but in the Net Zero Emissions Scenario, they account for 35% of total truck sales in 2030. Aviation and shipping will consume 10 million barrels per day of oil in 2021, a 20% reduction from pre-COVID-19 levels. In the Stated Policy Scenario, where economic growth boosts global trade and international travel, oil demand grows by 4 million barrels per day between 2021 and 2030. In the Pledge Target Scenario, increasing the use of alternative fuels to meet government and industry climate targets increases oil demand by 3 million barrels per day by 2030. In the net-zero emissions scenario, the choice of low-emission liquid fuels would result in little increase in oil demand by 2030.

3. Petroleum demand in the chemical industry will continue to increase under all scenarios

The chemical industry is the only sector to increase oil consumption in 2020, and its share of oil consumption rises in each scenario. Currently, approximately 70% of petroleum used as a petrochemical raw material is used to produce plastics. Several countries have currently announced policies to ban or reduce the production of single-use plastics, increase recycling rates and promote alternative raw materials. By 2050, the global average plastic recycling rate will increase from the current 17% to 27% in the Stated Policies Scenario, to 50% in the Pledge Target Scenario, and to 54% in the Net Zero Emissions Scenario.

4. Increase upstream investment in oil production to ensure a balance between oil supply and demand

In the Stated Policy Scenario, rising demand and falling production from existing sources of oil production implies the need for new conventional upstream projects to ensure that supply and demand remain in balance. By 2030, annual spending on oil production upstream investment averages around $470 billion, 50% higher than current spending. In the Commitment Target Scenario, despite lower oil demand, new conventional projects are still needed, with an average annual investment of $380 billion to 2030. In a net-zero emissions scenario, the decline in fossil fuel demand can be met without the development of new oil projects, but with continued investment in existing assets, which would require an average annual upstream investment of $300 billion by 2030 .

5. In 2021, global refining capacity will decline for the first time in more than 30 years

Refining margins have soared to record highs as demand rebounds in 2022 and exports of petroleum products from Russia and China fall. In the Stated Policy Scenario, rising demand for diesel and kerosene means that the market is likely to remain very tight for several years. Strong policy measures to curb demand for liquid fuels would significantly ease this energy crunch in the Commitment Target Scenario. The Commitment Target Scenario and the Net Zero Emissions Scenario require refiners to adjust their current structural configurations and business models and invest more in emissions reductions, hydrogen and biofuels.

6. Demand for liquid biofuels will continue to increase in the future

Disruptions to food supply chains and high fertilizer prices mean the cost of liquid biofuels has skyrocketed. At the same time, growing concerns about sustainability have prompted increased attention to advanced liquid biofuels that do not directly compete with food and feed crops and avoid adverse impacts on sustainability. Liquid biofuels grow from 2.2 million barrels of oil equivalent per day in 2021 to 3.4 million barrels of oil equivalent per day in 2030 in the Stated Policies Scenario and to 5.5 million barrels of oil equivalent per day in the Committed Targets Scenario, This would increase to 5.7 million barrels of oil equivalent per day in a net-zero emissions scenario.

7. Gas fuel outlook

1. The era of rapid growth in global natural gas demand is coming to an end

The depth and breadth of the current global energy crisis has raised concerns about the future cost and availability of natural gas, severely undermining firm ideas about its use as a transition fuel. In the Stated Policy Scenario, gas demand grows by less than 5% between 2021 and 2030, compared with 20% growth over the past decade. From 2030 to 2050, global natural gas demand will remain at about 4.4 trillion cubic meters, with increasing demand in emerging market and developing economies offset by weaker demand in advanced economies. In the Committed Target Scenario, global gas demand peaks soon, with demand in 2030 10% below 2021 levels. In the net-zero emissions scenario, demand falls by 20% by 2030 relative to 2021 levels and by 75% by 2050.

2. The energy crisis will lead to a continuous reduction in the demand for natural gas in the EU

At present, Russia’s pipeline gas exports to the EU have more than halved compared with last year, and the total export volume is expected to be 60 billion cubic meters in 2022. A further 45 bcm would be reduced by 2030 in the Committed Targets Scenario and to zero in the Stated Policies Scenario. Two options, additional LNG imports and non-Russian pipeline gas, will play an important role. In the Commitment Target Scenario, the increases in wind and solar capacity are more pronounced and lead to more building retrofits and heat pump installations, measures that would help EU gas demand fall by 40% between 2021 and 2030 %, that is, 180 billion cubic meters.

3. Global natural gas prices will begin to gradually decline in the mid-2020s

Due to the reduction of natural gas imports from Russia and the lack of new natural gas import projects in Europe, it means that in the next few years, in the established policy scenario and the committed target scenario, the price of European natural gas imports will still be high. In a net-zero emissions scenario, natural gas demand would decrease rapidly in all regions of the world, global natural gas supply pressure would ease, and natural gas import prices would fall rapidly. Gas prices begin to decline gradually in the mid-2020s in both the Stated Policies Scenario and the Committed Targets Scenario, as gas demand flattens and new supply projects currently under construction come on stream. The decline in domestic natural gas demand in the United States creates an opportunity to increase LNG exports. In the Stated Policy Scenario and Committed Target Scenario, the United States will soon surpass Russia to become the world’s largest natural gas exporter. In the Stated Policy Scenario, China’s natural gas demand growth will slow down significantly, with a demand reduction rate of 2% per year between 2021 and 2030, compared with an average annual growth rate of 12% over the past decade. China has already signed a large number of LNG contracts over the next 15 years, and together with the expected supply from existing pipelines and new domestic projects, this capacity exceeds China’s demand for natural gas by 2035 in the Stated Policy Scenario.

4. The high price of natural gas has weakened the prospect of large-scale application of coal-to-gas conversion

In emerging markets and developing Asia in Asia, long-term gas import contracts with prices tied to oil provide consumers with partial protection from high and volatile gas prices, in some cases backed by domestic subsidized support. Growing populations and strong economies provide a solid basis for growth in gas demand in these regions: by 2030, gas demand in these emerging markets in Asia will increase by 20% to 12 billion cubic meters in the Committed Target Scenario, of which about 70 billion cubic meters % growth was due to imports of liquefied natural gas. Growing gas demand in parts of Asia and EU measures to import non-Russian gas underpin LNG demand growth in all scenarios until the mid-2020s, but there will be a dramatic change thereafter. In the Stated Policy Scenario, an additional 240 billion cubic meters of export capacity per year would be required by 2050, in addition to projects already under construction. In the committed target scenario, only projects currently under construction are required. In a net-zero emissions scenario, the sharp decline in global gas demand means that projects currently under construction will in many cases no longer be needed. This has prompted investors in large capital-intensive LNG projects to face a key dilemma: the imbalance between strong demand growth for gas in the short term and the uncertainty that gas demand may decrease in the longer term.

5. Russia will face a difficult choice in finding new natural gas export markets

Sanctions have dampened prospects for new major LNG projects in Russia, while the distance to alternative markets for gas exports has made new pipeline connections difficult. In the committed target scenario, Russia’s share of international gas transactions would fall from 30% in 2021 to less than 15% in 2030, and its net gas export revenue would fall from $75 billion in 2021 to $25 billion in 2030. Dollar.

6. The application prospect of low emission gas is bright

In the Committed Target Scenario, low-emissions hydrogen production would rise from current low levels to over 30 million tonnes per year by 2030, equivalent to more than 100 billion cubic meters of natural gas. Biomethane production would also increase in the committed target scenario. Governments should play a key coordinating role in the growth of low-emitting gases, especially in setting standards and ensuring reliable long-term demand.

8. Outlook for solid fuels

1. The current coal demand growth is strong, but the long-term trend still depends on the world’s determination to deal with climate change

As the world recovers from the epidemic, global coal demand will rebound strongly to 5.64 billion tons in 2021, and coal-fired power generation will reach an all-time high in 2021. Both China and India have stepped up investment in domestic coal production, but global output has struggled to keep pace with demand growth, sending coal prices soaring. The conflict in Russia, the world’s third-largest coal exporter, has complicated the coal market and put additional pressure on coal prices. The future of coal depends largely on the world’s determination to tackle climate change. In the Stated Policy Scenario, coal demand will gradually decline. In the committed target scenario, coal demand falls by around 20% from current levels by 2030 and by 70% by 2050; coal demand in China and India peaks in the early 2020s and late 2020s, respectively. In the 2050 net-zero emissions scenario, demand would fall by 45% by 2030 compared to today, and by 90% by 2050.

2. Future carbon capture, utilization and storage technologies will be widely used