“Household energy storage” suddenly exploded, and the reason was found!

Recently, a branch of new energy energy storage – energy storage for household users, has suddenly exploded in the global market.

“Just like the air conditioners in the 1990s”, some market veterans gave such a metaphor to household energy storage.

There are two meanings behind this: one means that it is entering thousands of households in overseas markets like air conditioners in the 1990s; Quite, home all-in-ones are gradually becoming a trend.

We see that the current household energy storage has opportunities with low penetration rate, strong overseas policy support, and high customer demand. In developed countries with high electricity prices such as Europe, the United States, Japan, and Australia, it has good economics, rigid demand, and Strong willingness to pay and price acceptance.

At the same time, under the influence of the sharp rise in global energy prices, the home energy storage market is showing a trend of explosion in Europe and the United States, especially the European home energy storage is leading the world.

Going back to the 1990s, the air conditioner made Gree Electric rise up, and it has continued to grow for more than 20 years, becoming a globally influential company.

At present, will household energy storage also be a track with long slopes and thick snow? What opportunities will this bring to A-share investors?

Household energy storage is the first to break through, and the capital market is turbulent

Due to the lack of a clear business model, the energy storage industry has been troubled by the difficulty of making profits.

The “White Paper on Energy Storage Industry Research 2022” issued by the Zhongguancun Energy Storage Industry Technology Alliance pointed out that “the energy storage industry will usher in unprecedented attention and a hot investment climax in 2021”, but “most of the energy storage projects that have been put into construction have not yet formed. Stable and reasonable income model”, “Many small and medium-sized enterprises are still struggling”.

Haitong Securities released a research report on May 26 and believes that energy storage still faces obvious profit difficulties on the power generation side and the grid side, that is, the investment rate of return is too low, which is an important reason hindering the large-scale development of the industry. Everbright Securities pointed out that before the domestic “new energy power generation + energy storage” has not reached parity, the development of energy storage largely depends on policy support and subsidies. If “new energy power generation + energy storage” cannot compete with thermal power prices, it will will affect the demand for energy storage.

However, in the current situation of tight energy supply and rising raw material prices, household energy storage is undoubtedly the first to break through. Global companies are accelerating the race for home energy storage.

Relevant data show that the top three global household energy storage product shipments in 2019 are Tesla, LG Chem, and Pine Energy, accounting for 15%, 11%, and 8.5% respectively. In 2020, this data will undergo a new round of refresh, and the top five global household energy storage product shipments will be changed to Tesla, Pine Technology, Germany’s Sonnen, LG Chem, and China’s Wotai Energy.

The latest statistics show that in the field of household energy storage, Tesla, with its outstanding product strength and brand effect, accounts for 15% of the global household energy storage market, followed by Power Technology (2.62%), accounting for 13%. %, the gap between them is gradually decreasing.

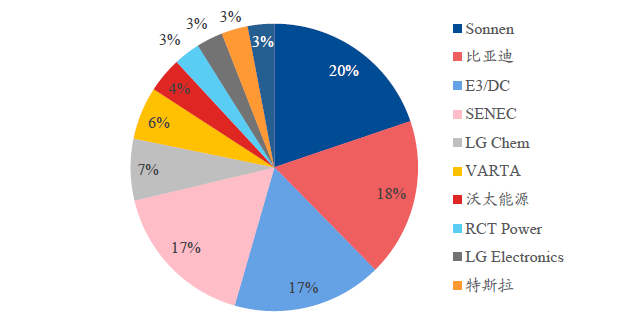

In Germany, where the household energy storage penetration rate is relatively high, Sonnen has the highest market share in the household energy storage market, followed by BYD (5.63%). It can be seen that Tesla, Paineng Technology, Sonnen, BYD, LG Energy and other Chinese and foreign companies are competing to open the acceleration mode in the global household energy storage market.

Under the wind, Paineng Technology has recently quickly become the “darling” of the A-share market. On July 15, the closing price of Paineng Technology was 426.01 yuan. In the past four months, Paineng Technology has risen from 112.41 yuan/share to 426.01 yuan/share, an increase of 279%. In addition, household energy storage stocks such as GoodWe and Jinlang Technology also ushered in a surge.

As the “big brother” of China’s household energy storage, Power Technology ranks second in the world in terms of global shipments, second only to Tesla Powerwall, which ranks first in the global household energy storage list.

According to some organizations, under the general trend of carbon-neutral development, household energy storage will become the fourth high-speed growth track in the new energy industry after wind power, photovoltaics, and electric vehicles.

Why the sudden outbreak? Technology, Cost and Needs!

In fact, household energy storage is not a “new gadget”. Why is it suddenly breaking out now?

From the perspective of the supply side, technological changes have greatly improved the convenience and practicality of products.

With the upgrading and progress of lithium battery technology and the continuous reduction of cost under large-scale commercial application, these have provided conditions for the explosion of portable energy storage products. It is understood that the large-scale production of energy storage batteries is inseparable from the substantial increase in energy density brought about by breakthroughs in lithium battery technology. Taking Tesla as an example, the first electric car Roadster launched in 2008 had a cell energy density of only about 55Wh/kg, but the 2021 Model 3 launched in 2020 has an energy density of more than 300Wh/kg. .

At the same time, with the large-scale commercial application of lithium batteries and the increase in research and development investment, although the price of lithium ore remains high, the average unit cost of lithium battery packs is still showing a continuous downward trend. According to data from Bloomberg New Energy Finance (BNEF), the average unit cost of lithium battery packs has dropped from US$684/kWh in 2013 to US$132/kWh in 2021, a drop of 80.70%. The cost reduction has also further promoted the rollout of home energy storage products.

The underlying reason for the popularity of household energy storage is mainly from the demand side.

On the one hand, electricity prices in Europe have risen significantly, and the conflict between Russia and Ukraine has exacerbated the energy crisis in Europe. European energy prices have exceeded 200 euros/MWh, and European natural gas prices have increased by more than 8 times since 2020.

The low cost of photovoltaic storage allows European and American consumers to recover their investment costs within 3-5 years. Since 2021, household energy storage has shown explosive growth in the European and American markets with an annual growth rate of doubling.

In 2021, the 27 EU countries will add 25.9GW of grid-connected photovoltaics, providing good conditions for household energy storage.

The current typical application scenario of household energy storage is to form a household photovoltaic storage system with household photovoltaics. According to estimates, compared with not equipped with photovoltaic and energy storage systems, equipped with photovoltaic and energy storage equipment can save electricity costs of 12,673.64 euros in ten years, and the investment payback period is 5 years; while only installing photovoltaic systems saves electricity costs of only 4,816.87 euros, photovoltaic + storage Energy solutions are highly economical.

In recent years, domestic energy storage has grown rapidly in Europe. According to statistics, more than 90% of household energy storage in Europe is concentrated in the top five countries—Germany, Italy, the United Kingdom, Austria, and Switzerland. Among them, Germany is the largest domestic energy storage market in Europe.

Overall, the explosion of the European home energy storage market is mainly due to its excellent economy.

On the other hand, the demand for home energy storage in the United States is also rising rapidly, and giants such as Tesla have further improved the economics of home energy storage. Relevant data show that the total new installed capacity will reach 63.4GW/202.5GWh from 2021 to 2026, of which household use can reach 4.9GW/14.3GWh.

Recently, Tesla has partnered with California public utility company PG&E to create a new virtual power plant (VPP), providing eligible Powerwall users with a remuneration incentive of $2 per kWh. It is reported that 50,000 Powerwall users will be eligible for the subsidy.

According to the market power demand situation and the number of Powerwall users, no matter where they are, they can have an income of 10-60 US dollars for each power dispatch. The economics of home energy storage will also be further highlighted in the US market.

How long is the “slope” of household energy storage?

It is said that 2022 is the first year of the energy storage market explosion. Judging from the current situation, this judgment has been verified, especially in terms of household energy storage. So, from a longer-term perspective, how long will the “slope” of household energy storage be?

Or look at it from both the demand side and the supply side.

On the demand side, under the current cost, household energy storage can only be economical if it is matched with household photovoltaics, so first consider the demand for household photovoltaics. According to Infolink statistics, it is estimated that the household photovoltaic penetration rates of the United States, Germany, Japan, and Australia will increase from 3.3%, 11.1%, 11.1%, and 21.1% in 2020 to 6.6%, 21.5%, 15.8%, and 2025 respectively in 2025. 34.0%.

While the penetration rate of household photovoltaics is increasing, the penetration rate of solar-storage integration in household photovoltaics is also increasing. By 2025, the penetration rates of solar-storage integration in the United States, Germany, Japan, and Australia will increase significantly from 7.6%, 20.8%, 17.2% and 3.8% to 18.8%, 46.6%, 38.5% and 8.4%, respectively. More than double the improvement.

Overall, the penetration rates of solar-storage integration in the United States, Germany, Japan, and Australia will increase from 0.25%, 2.39%, 1.75%, and 0.80% in 2020 to 1.24%, 10.02%, 6.08%, and 2.86% in 2025. %, and the improvement rates are 4.96 times, 4.19 times, 3.47 times and 3.58 times respectively.

In addition to the increase in penetration rate, the increase in electrical equipment such as electric vehicles will also increase the per capita electricity consumption of residents, which in turn will promote the increase in the power of a single solar storage system, thereby bringing greater room for industry growth.

Based on the above analysis, Sealand Securities made the following forecasts for the market demand for household energy storage in the United States, Germany, Japan, and Australia in the next four years:

Based on this calculation, from 2021 to 2025, the average annual growth rate of the domestic energy storage market space in the above four countries will be as high as nearly 60%.

Let’s look at the supply side.

The point of view on the supply side is mainly to reduce costs. Since the energy storage system is mainly batteries and converters, the cost reduction of these two links is the top priority.

In terms of batteries, the current electrochemical energy storage mainly uses lithium batteries. However, due to the high prosperity of the downstream electric vehicle market, both the ternary cathode and lithium iron phosphate have been at high prices this year. However, with the substantial expansion of lithium salt plants, the supply and demand pattern will gradually change from 2023, and the downward cost is a high probability event.

In terms of converters, the IGBT, the core component of current converters, has very high technical requirements and is almost completely dependent on overseas semiconductor giants, so the cost is relatively expensive. In the future, under the opportunity of domestic substitution, with the rise of domestic IGBT manufacturers, the cost of IGBT and converters will gradually improve.

When the overall cost of energy storage falls, not only solar-storage integration, but also installing household energy storage alone will become economical, which will open up a new growth curve for household energy storage.

How to seize investment opportunities?

So, how should we view the investment opportunities of A-share household energy storage?

From the perspective of the large market space, in addition to the growth of the overall market space for household energy storage in the future as analyzed above, domestic energy storage companies have the potential to further increase overseas penetration. Because in the United States and Germany, the two largest domestic installed capacity markets in the world (the total installed capacity will account for 48% of the world in 2020), the penetration rate of domestic energy storage companies is not high.

For example, in the German market, the top four companies accounted for 72% of the market share, but only BYD entered the top four.

The U.S. market is even more exaggerated, and Tesla is the only one, accounting for 73% of the market share.

Therefore, although domestic household energy storage companies such as Powereng Technology have achieved a large market share in overseas markets, there is still great potential to be tapped.

Specific to investment opportunities at the company level, since energy storage batteries and converters account for 80% of the cost of energy storage systems, the opportunities are mainly in these two types of enterprises. Among these two types of enterprises, they can be subdivided into the following four types of companies according to the specific links involved.

One is companies that only provide battery cells, such as Penghui Energy, Yiwei Lithium Energy, and Ruipu Energy;

The second is to provide energy storage system providers who not only provide batteries, but also cover modules and PACKs, such as Paineng Technology, BYD

The third is companies that only provide converters, such as Jinlong Technology and Deye.

Fourth, converter companies that provide system integration services, such as GoodWe and Sungrow.

No matter which type of above, the key to look at three points:

One is how much energy storage accounts for the company’s revenue. For example, BYD, Yiwei Lithium Energy, etc., their performance mainly depends on automobiles, and the flexibility of energy storage business is not so great.

The second is to look at the proportion of overseas income. Because the short-to-medium-term opportunities for household energy storage are still overseas, whoever has the best overseas channels and is the first to gain recognition from local consumers and form a brand effect may take the lead.

The third is to look at the scope of business coverage. In general, energy storage system providers that cover the PACK link have a higher gross profit rate than companies that provide batteries alone; converter companies that do integrated business have a higher gross profit rate than those that sell converters alone. Machine companies are even higher.