-

0 +Years of company establishment

-

0 +Foreign trade sales

-

0 +R & D personnel

-

0 +Patent certificate

Solutions

SolutionsPRODUCT

PRODUCTABOUT US

ABOUT US

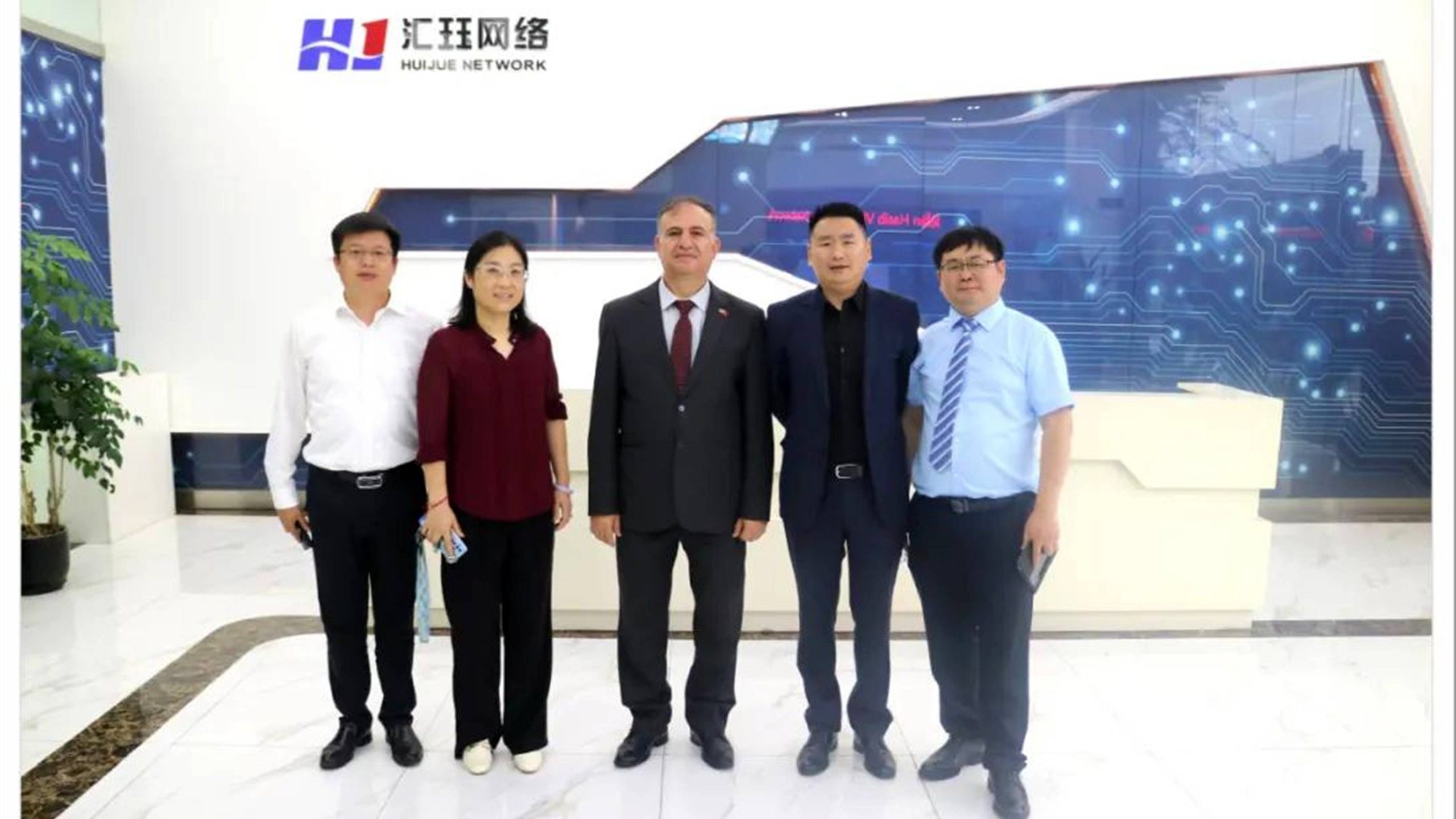

Founded in 2002, Huijue Networks is a high-tech service manufacturer integrating intelligent network communication equipment and an integrated application of computer intelligent network communication systems. The company is committed to becoming a leader in the network link industry. Headquartered in the Lingang New Area of Shanghai Free Trade Zone, with a registered capital of 107.78 million yuan, it currently has 6 wholly-owned subsidiaries across the country. Three production bases have been established in Fengxian, Jiangsu, Hai’an, Jiangsu, and Yangzhou, Jiangsu.

NEWS

NEWS

|

|